The debt ceiling has saved the United States from adverse economic effects, including the worst-case scenario: a default. The restriction has been used by the federal government to maintain its credentials as a good borrower. An outstanding credential is crucial for the U.S., which has the highest debt in the world.

What is the debt ceiling?

When the government spends more than its collected revenues, the federal government experiences a deficit, forcing the U.S. Treasury to borrow from other nations, organizations, government accounts, and trust fund surpluses. The debt ceiling is the maximum amount the Treasury is authorized to borrow by issuing bonds.

Why the U.S. needs the debt ceiling

The debt ceiling is used to pay for existing government obligations, such as Social Security, Medicare, retirement benefits, military sales, interests on federal debt, tax refunds, and more. It can also be used to pay for other obligations that were agreed upon by Congress or the President in previous fiscal years.

When was the debt ceiling established?

Before the debt ceiling was enacted, Congress had to approve each loan by passing a separate law. The passing of the Second Liberty Bond Act in 1917 granted the Treasury fiscal responsibility to manage federal resources amid the U.S. entry into World War I. The legislation set an aggregate limit on all federal debts and specific debt issues.

Similarly, the law allowed the Treasury to sell Liberty Bonds, a war bond aiming to fund the federal government’s efforts during wartime. Congress freely allowed the sale of these war bonds as long as sales didn’t exceed the specified amount. Funds collected from these bonds enhanced borrowing flexibility to fund war efforts.

How does the debt ceiling work?

Congress can take two different approaches to enacting the debt ceiling: (1) increasing the debt ceiling by a fixed dollar amount or (2) suspending the debt limit for a specific amount of time. Here’s how each approach to the debt ceiling works.

Raising the debt ceiling by a fixed dollar amount

By raising the debt ceiling by a fixed dollar amount, Congress authorizes the Treasury to issue debt until the set limit is reached. A recent example of this is Congress raising the debt ceiling by $2.5 trillion in December 2021. From $28.9 trillion, the Treasury can borrow until the $31.4 trillion limit is met, which happened in January 2023.

Suspending the debt limit during a specific timeframe

The suspension of the debt limit on a specific timeframe removes the limit that the federal government can borrow. Once the set date elapses, the debt limit is set to all the accrued borrowing amount added to the previous debt limit. This is the current status of the debt ceiling of the United States, which is set to end in January 2025.

What is the current debt ceiling of the United States?

The federal government raised the debt ceiling from $28.9 trillion to $31.4 trillion from December 2021 through January 2023. Several months after the Treasury’s exhaustion of “extraordinary measures” to avoid defaulting on government payments, the President finalized the debt ceiling by signing the Fiscal Responsibility Act of 2023.

The current debt ceiling for 2023 in the U.S. is suspended until January 2025.

What happens if the U.S. defaults on its debts?

If Congress fails to finalize its decision on the debt ceiling, the worst that can happen is a default. A default occurs when it can no longer pay the interest on its debts or the principal debt repayments. This can lead to serious financial turmoil, not only domestically but also internationally, as most countries depend on the stability of the U.S. economy.

Increased interest rates in public and private loans

One of the most notable repercussions of the U.S. default is the increase in interest rates. Higher interest isn’t a good look for investors of Treasury securities, which scales back growth, not only in the federal sector but also in private businesses. Even a scare of default can cause interest rates for car loans, credit cards, mortgages, and business loans to increase.

Unemployment increases amid a potential recession

Prolonged defaults can lead to a widespread recession, where banks, creditors, and financial institutions tighten the availability of credit because of the uncertainties in Treasury holdings. Once a recession starts, a snowball effect ensues, causing an increase in unemployment rates, a stock market crash, a hit in the savings of Americans, and more.

How many times has the U.S. hit the debt ceiling?

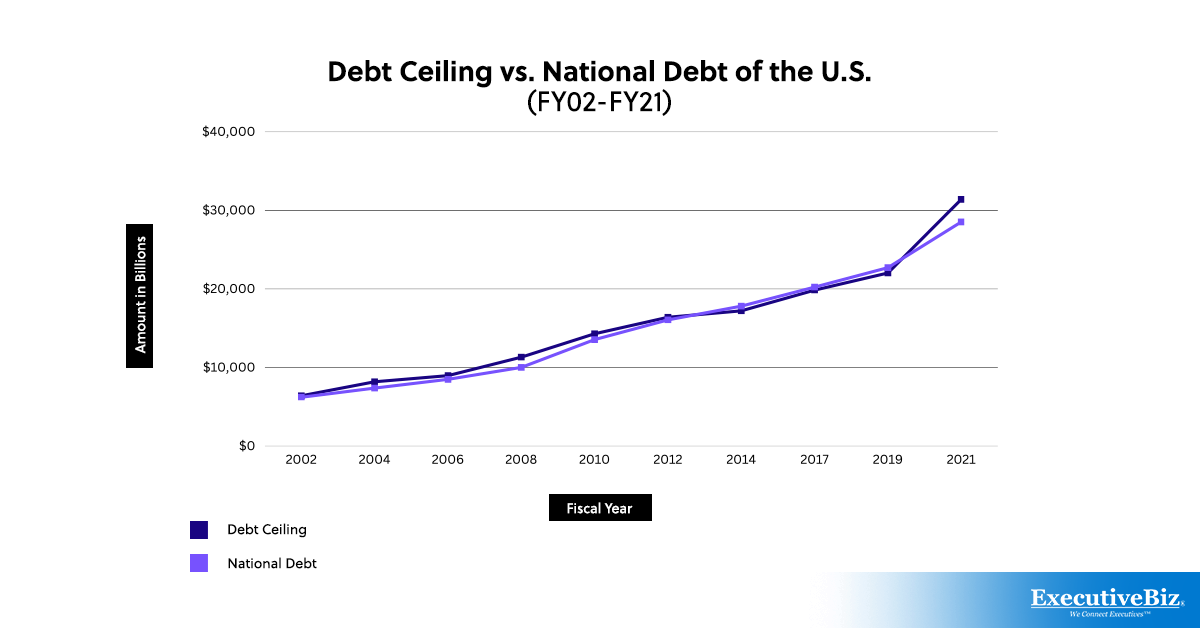

Since 2002, the United States has been running on deficits, forcing the nation to borrow increasingly every year to meet its financial obligations. The accumulation of deficits has put the nation into a debt crisis, so it’s no surprise that the debt ceiling has been raised or suspended over 20 times during the past two decades.

Hitting the debt ceiling over and over again presents an issue that the federal government needs to address immediately. Otherwise, raising or suspending the debt limit may not be enough to put the U.S. economy on default or, even worse, a depression as widespread as the Great Depression during the 20-30s.

Funding lapses aren’t unique conditions that stem from failing to raise the debt ceiling. A government shutdown can also cause funding gaps by failing to pass appropriate bills.

Click here for a rundown of the government shutdown in the U.S.

How can the debt ceiling prevent a default?

By raising or suspending the debt ceiling, the United States maintains the payment of its obligations. Even when the debt limit is reached, extraordinary measures can spur into action to prevent a default at all costs. However, they’re not the solutions; they are only meant to buy time until the federal government sorts out its finances.

Unless Congress amends the debt ceiling, time is ticking before the federal government goes into a default. Amid the year-on-year deficits, global pandemic, and recessions, policymakers continue to create laws to better manage the ballooning national debt of the United States, which stands at $33.1 trillion and is growing.

The United States can look into measures done by another nation that maintains a debt ceiling: Denmark. Unlike the U.S., Denmark hasn’t been hitting its limit all that often. In 2021, its debt ceiling stands at 14% above its national debt. On the contrary, the U.S. has hit its debt ceiling every time it raises the limit.

Fortunately, although the United States has experienced some sort of defaults over the past few decades, none of which resulted from Congress’ inaction to amend the debt ceiling.

What are extraordinary measures?

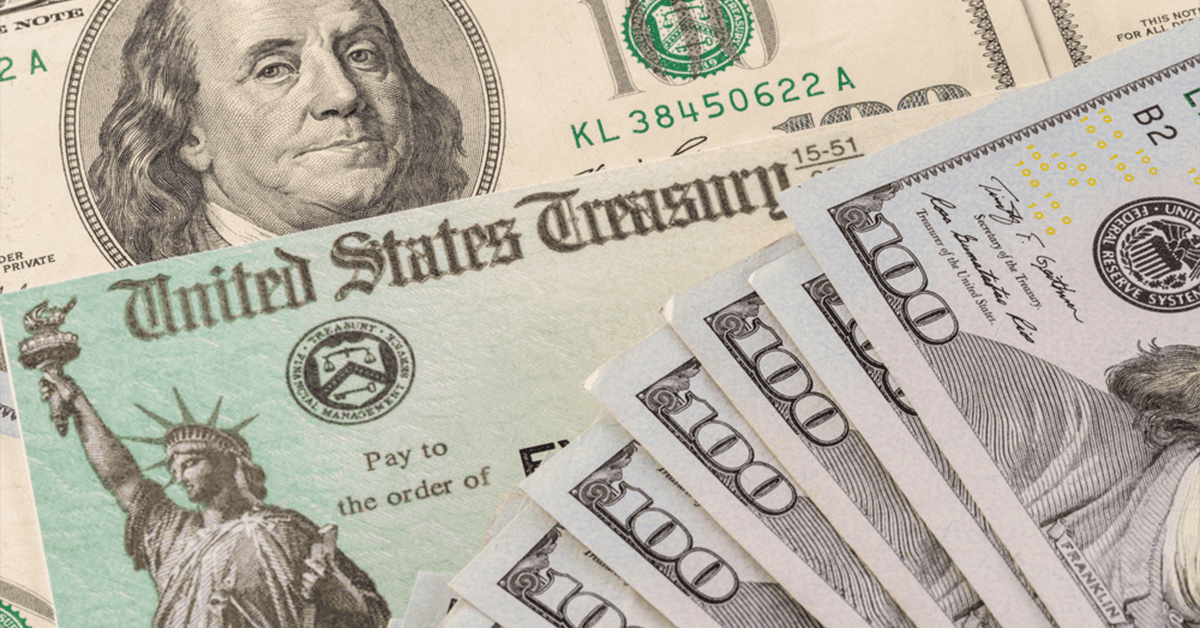

Once the increased debt limit is hit or the suspension date is reached, the federal government must take “extraordinary measures” to prevent defaulting on government obligations. At whatever cost, the Treasury must employ cash-saving instruments, even at the cost of disruption of payments and investments in some government functions.

One of the most common extraordinary measures is to suspend the daily reinvestment of government trust funds, such as retirement funds and currency exchanges. Instead of letting these funds mature, the Treasury redeems its portfolio securities prematurely, uses them to pay existing obligations, and replaces them with interest later on.

Example of an extraordinary measure

In August 2021, the Treasury suspended the reinvestment of the G Fund, a retirement fund for federal employees to pay for over $270 billion in debt. The agency borrowed over $262 billion from the retirement fund to raise cash and pay its bills. It was later paid back in full, including interest, in December 2021.

What usually happens when all extraordinary measures are exhausted?

Once all extraordinary measures are exhausted, the federal government is no longer able to borrow money. This forces the government to rely on its cash on hand, which may be insufficient to pay its millions of obligations before they are due. When this happens, the government has no choice but to opt for a partial default by prioritizing some of its obligations.

Eventually, even the cash on hand of the federal government will run out. When this happens, even some of its “priorities” will run out of funding, which is most likely to lead to a complete technical default. The only way to curb or reverse this worst-case scenario is for Congress to decide on the debt ceiling.

What are the controversies surrounding the debt ceiling?

The debt ceiling has helped the United States avert a number of close calls to default; however, it’s not a perfect system. As the federal government hits the debt ceiling more frequently than ever, issues about its effectiveness in instilling fiscal responsibility and handling national debts have been raised.

Going against the 14th Amendment

Some critics have questioned the constitutionality of the debt ceiling as it goes against the 14th Amendment, stating, “The validity of the public debt of the United States, authorized by law…shall not be questioned.” This mandates the government to meet its obligations according to stipulations and not raise or suspend them when deemed unattainable.

Promoting fiscal irresponsibility

The fluid nature of the debt ceiling raises the eyebrows of some experts because it may do more harm than good. Instead of allowing for more fiscal responsibility, which is the main goal of the debt ceiling, it has become an economic band-aid to avoid defaulting on government payments and obligations.