Photo by Drazen Zigic from Shutterstock.com

Humana Inc. is a healthcare company dedicated to improving health outcomes by providing equitable access to high-quality tools and support. The company provides senior health insurance, Medicare, services and benefits, and prescription drugs. Take a look at the top Humana government contracts listed below.

1. DoD Awarded for South Region TRICARE and Healthcare Service Delivery, $67.43 Million

Image by Niyazz from Shutterstock.com

- Contracting activity: Department of Defense

- Value: $67.43 Million

- Contract type: Cost-plus-fixed-fee

- Contract date: February 2011

Since 1996, Humana has provided services to over three million active uniformed members, military retirees, and military family members. In February 2011, the Department of Defense again entrusted Humana’s subsidiary, Humana Military Healthcare Services, to deliver services to the entire TRICARE South Region.

Apart from the South Region, Humana is also in charge of the TRICARE East Region, formed in 2018 after the merger of TRICARE South and North Regions. The TRICARE program provides comprehensive coverage from health plans, prescription drugs, and dental plans to its members in the military.

2. Managed Care Support (MCS) to TRICARE’s East Region, $40.5 Billion

Image by Panchenko Vladimir from Shutterstock.com

- Contracting Activity: Defense Health Agency

- Value: $40.5 Billion

- Contract type: Cost-plus-fixed-fee

- Contract date: July 2016

The Humana Government Business Inc. was selected to provide managed care support to the TRICARE East Region, specifically by ensuring that an integrated healthcare delivery system is in place. In this partnership, Humana’s resources will be used with the military’s medicare care system to provide health, medical and administrative support to its beneficiaries.

Humana is granted an estimated $40.5 billion contract budget if all options are exercised. The project will commence with an initial budget of $67 million for its nine-month base period. There will be five one-year option periods for health care delivery and a transition-out period that will use up its total budget.

3. Partially Privatized Medicaid Program in Oklahoma, $2.1 Billion

Image by Tada Images from Shutterstock.com

- Contracting Activity: Oklahoma Health Care Authority (OHCA)

- Value: $2.1 Billion

- Contract type: Healthcare contract

- Contract date: June 2021

The Oklahoma Health Care Authority (OHCA) required Humana’s expertise in administering its Medicaid program. Humana’s subsidiary, Humana Healthy Horizons, will facilitate the partial privatization of Oklahoma’s Medicaid program (formerly SoonerCare) and the Children’s Health Insurance Program, providing temporary aid for Needy Families and expanding Medicaid for residents of Oklahoma.

4. DHA Modification to Previously Awarded TRICARE East Region MCS Contract, $121.9 Million

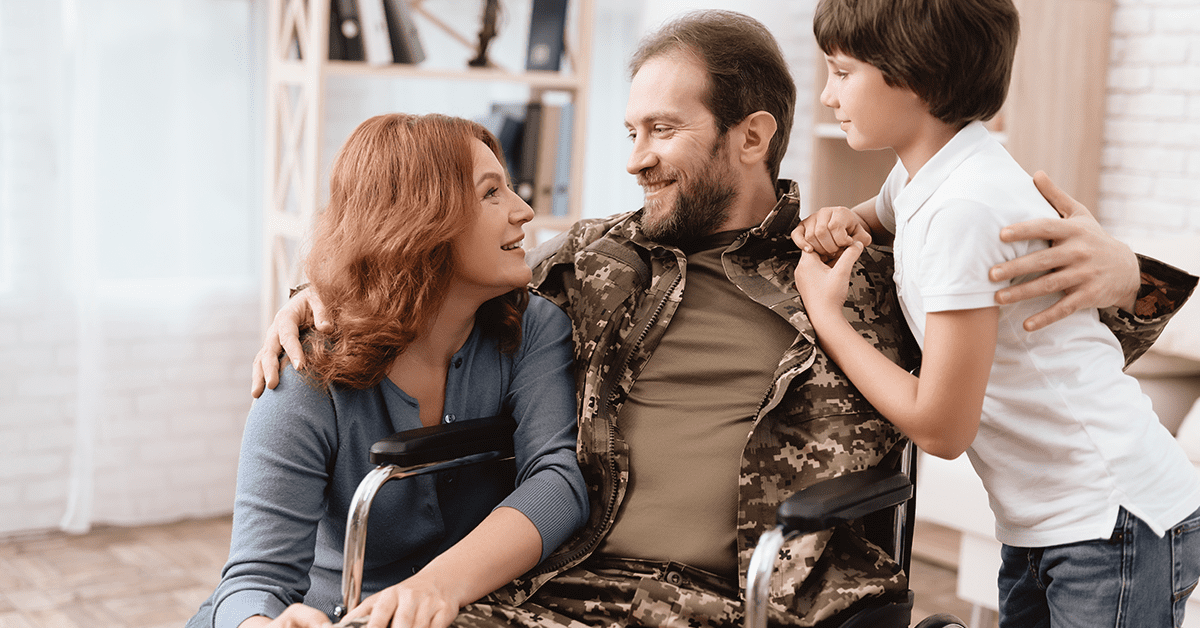

Image by Drazen Zigic from Shutterstock.com

- Contracting activity: Defense Health Agency

- Value: $121.9 Million

- Contract type: Modification to an existing award

- Contract date: December 2021

Humana Inc. has been awarded a $121.9 million contract modification to the previously awarded fixed-price T2017 East Managed Care Service Contract. The modification implements changes to the Military Health System mandated by the 2017 National Defense Authorization Act, specifically replacing TRICARE Extra and TRICARE Standard health programs with TRICARE Select.

Work will be done throughout the eastern part of the continental U.S. between January 1, 2017, and December 31, 2022.

5. Project ARCH Awarded by VA to Enhance Availability of Health Care for Qualified Veterans

Image by VGstockstudio from Shutterstock.com

- Contracting Activity: Department of Veteran Affairs

- Contract date: December 2021

The Department of Veterans Affairs (VA) awarded the Project ARCH (Access Received Closer to Home) contract to Humana Veterans Healthcare Services, a subsidiary of Humana Military Healthcare Services owned by Humana Inc.

Project ARCH aims to enhance access for qualified Veterans by integrating them into healthcare services relatively close to home while maintaining the high quality of care provided by the VA healthcare system. The Project ARCH contract has a three-month base period and three one-year option periods that the VA can exercise.

The following are four of the five pilot VISNs identified by VA:

- VISN 6 Farmville (Hunter Holmes McGuire VA Medical Center)

- VISN 15 Pratt (Robert J. Dole VA Medical Center)

- VISN 18 Flagstaff (Northern Arizona VA Health Care System)

- VISN 19 Billings (Montana VA Health Care System)

About Humana Inc.

Extendicare (now renamed Humana, Inc.) was founded in 1961 by David A. Jones, Sr., and Wendell Cherry. It dominated the nursing care industry in the United States in 1972. It renamed itself Humana, Inc. after selling its nursing home chain and beginning to buy hospitals around 1974. The company provided affordable health insurance policies as the American healthcare system evolved.

Humana government contracts provide a wide range of insurance products and health and wellness services integrative to lifelong well-being. It provides a flexible, agile, and responsive organizational structure to the evolving needs of the Department of Veterans Affairs (VA) and the Veterans who rely on VA services.