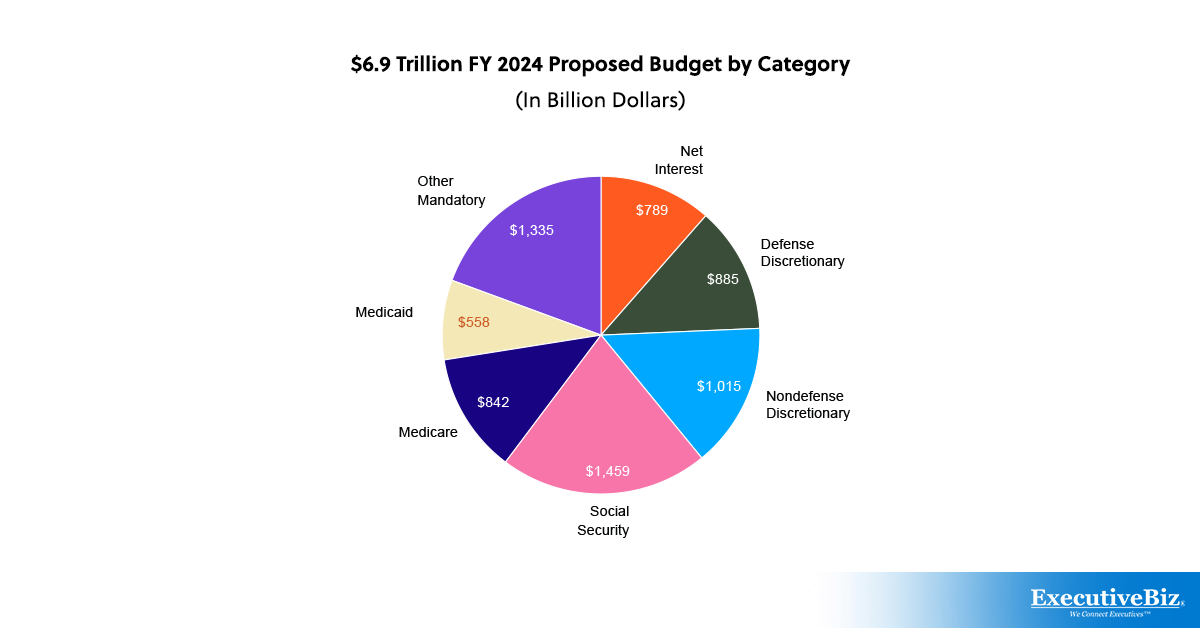

President Joe Biden’s $6.9 trillion federal budget request for the fiscal year 2024 aims to strengthen Medicare and Social security, reduce child and American worker taxes, and improve health care and drug accessibility.

The current administration was implementing plans to rebuild the American economy from the bottom up and middle out. In just two years, the President has collected a historic list of legislative achievements and executive measures building the groundwork for long-term, sustainable economic growth.

This article provides comprehensive information about the federal budget allocations and recent budget outlays.

What is a Federal Spending?

Federal spending is the term used when the government uses the country’s budget for federal expenditures. All government activities rely on funds approved by Congress and signed by the president. In the United States, federal spending has two primary groups: the mandatory and discretionary spending.

Mandatory spending

All expenditures that do not fall within appropriations laws are considered mandatory spending. In fact, the government must ensure that all eligible individuals receive program benefits.

Approximately two-thirds of all federal spending goes to the mandatory budget. Some examples of mandatory spending include programs that people have rights to, like Social Security and Medicare, and interest payments on the government debt.

Discretionary spending

Discretionary spending is the part of the budget that Congress decides on an annual basis through the process of appropriations. In most years, appropriations bills cover about a third of federal government operations.

Some examples of discretionary spending include budget allocations for education, housing, community, health care, unemployment, agriculture, and medical research and development. Almost all educational programs are funded under discretionary spending except for a few tax benefit programs, student loans, selective vocational grants, and school lunches.

Federal Budget: Government Spending Top Priorities FY 2024

The image shown above is the budget allocations for the federal budget in 2024 based on Office of Management And Budget. With it, President Biden outlines the top priorities of government spending in 2024.

Read on as we unpack the recent budget projections of the U.S. federal government.

Create Breathing Rooms for Families by Reducing Costs and Taxes

The Biden-Harris Administration takes action to support American families by providing steps to lower taxes, provide cost-effective healthcare, and eliminate junk fees. The President’s budget proposes a set of measures to keep everyday prices down for the citizens of the United States.

Restore Child Tax Credit and Cut Taxes for American Workers

The Child Tax Credit (expired last December 2021) is requested to make it permanent in 2024. The Child Tax Credit is financial assistance for American families with dependent children ages 6 to 17. The tax benefit grant helps families lower the cost of living of working families. It would be completely refundable after being permanently reformed in the Budget.

Provide Affordable and Safe Homes

The President also visions make it possible for families to have affordable and safe homes. Some of the steps to do this include offering affordable housing supply, homeownership, and rent, lowering housing costs. This will also address the country’s shortage for housing in communities.

The budget allocates $59 billion in mandatory financing and tax incentives to expand the supply of low-income households. If Congress approved these project requests for Increase Affordable Housing Supply, the budget will be grouped into the following spending:

- $28 billion for Housing Credit expansion

- $16 billion for a Neighborhood Homes Tax Credit

- $7.5 billion for new PBRA contracts

- $7.5 billion for public housing’s urgent necessities

Make HealthCare More Accessible

The Budget builds on the remarkable accomplishments of the Affordable Care Act (ACA) by making long-term average $800 per year price cuts made possible by the Inflation Reduction Act’s expanded premium tax credits. This is because more people can now afford health insurance than ever before.

It offers financial incentives to states that have already expanded Medicaid under the ACA and provides Medicaid-like coverage to residents of those states that have not done so.

Under this mission, the government objectives include:

- Lower the prices of prescription drugs

- Provide affordable quality early child care and learning.

- Support American Families and Homes

Besides bringing safe and affordable homes, the government is eager to improve the quality of life of every American family and home. Here are the 2024 budget proposals that will significantly assist families and children.

- $500 increase in the maximum allowable Pell Grant at the government’s discretion to improve access to free community college and reduce tuition costs

- $4.1 billion offer for the Low Income Home Energy Assistance Program (LIHEAP)

- $15 billion to increase food security in eligible states and schools

Moreover, the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC) is projected to serve 6.5 million people this year, and the budget allocates $6.3 billion to help cover its costs.

Strengthen Medicare and Protect Social Security

One of the current Administration’s top priorities is establishing a solid Medicare and Social Security to benefit future generations. The President will not support any legislation that would reduce benefits for seniors and those with disabilities who have paid into Medicare and Social Security throughout their working lives.

Enhance Medicare Services

Without reducing services or increasing expenditures, the budget strengthens Medicare by prolonging the Medicare Trust Fund’s solvency by up to 25 years. Investment in service delivery also prioritizes eligible seniors and disabled individuals to receive their benefits.

Secure Americans Under Social Security Benefits

The budget allocates an additional funding of $1.4 billion, a 10% increase above the 2023 approved amount, to the Social Security Administration for investments in people, information technology, and other upgrades. The Administration looks forward to working with Congress to strengthen Social Security responsibly by requiring higher-income earners to contribute their fair share.

Higher Quality of HealthCare and Health Outcomes

The President believes everyone should have access to quality healthcare. The scope of advancing health includes support for maternal health, Cancer Moonshot, and mental health care.

Fosters Health Equity and Maternal Health

When compared to other developed nations, the United States has the highest rate of maternal mortality. That is 32.9 deaths per 100,000 live births, according to a 2021 CDC report. The budget allocates $471 million toward these goals:

- Decreasing maternal mortality and morbidity

- Increasing access to maternal health care

- Addressing the highest rates of perinatal health disparities

- Expanding maternal health initiatives in rural areas

- Establishing pregnancy medical home demonstration projects

- Educating and promoting the perinatal health care workforce

In addition, all States must provide continual Medicaid benefits for 12 months postpartum, eliminating essential health insurance gaps.

Support the Cancer Moonshot Program Goals

The Cancer Moonshot is a government initiative to improve collaborations and drive progress against fighting cancer. It seeks to reduce the death rate from cancer by 50% in the next 25 years.

Under the $1.7 billion dedicated to Cancer Moonshot activities, the government looks forward to giving this support across the Department of Health and Human Services. There will also be a total of $7.8 billion investment for the National Cancer Institute for scientific research, prevention, and treatment of cancer.

Improve Behavioral and Mental Health Services

As the US is facing a mental health crisis, the authorities are taking steps to address it. The budget allows more people with private health insurance to get mental health benefits while strengthening the community of mental health services.

The funding also encompasses youth mental health care, behavioral health workforce, mental health research, Community Mental Health Centers, and Certified Community Based Behavioral Health Clinics.

Enhancing American Democracy, Equity, and Community Safety

In 2024, the government aims to invest in making the communities safer, strengthening democracy, and providing equal opportunity regardless of gender. The scope of the budget includes the following:

- Assign 100,000 additional police as part of a $19.4 billion crime prevention strategy that will last for over a decade.

- $1 billion to help programs run under the Violence Against Women Act of 1994 (VAWA)

- Increase and incentivize evidence-based foster care preventative measures to keep families together and minimize foster care admissions.

- Spending an additional $5 billion over ten years on election support is proposed in the spending plan to continue and expand efforts to preserve and improve American democracy.

Building Economic Stability by Investing in Its Core

Spending on economic foundations is a priority in the federal budget for 2024. The President’s financial plan also prioritizes increasing economic competition to benefit small companies and entrepreneurs.

Investment in Manufacturing, Innovation, and Research

There is a $375 million budget that supports the NIST Industrial Technology Services’ progress and promotes domestic technological production. It also includes the Manufacturing Extension Partnership and partnership support for SMEs, with $277 million in funding.

A $21 billion budget was allotted for CHIPS and Science Act-authorized activities under the discretionary spending proposal. The goal is to speed up and turn R&D into industries and deliver innovation and jobs.

The funding includes the following:

- $1.2 billion for the CHIPS and Science Act-authorized Directorate

- $300 million for NSF’s Regional Innovation Engines program

- $4 billion for the Economic Development Administration Regional Technology and Innovation Hub Program under the new mandatory funding

The budget invests $210 billion in Federal R&D, a record amount in American science, technology, and innovation.

You may be interested in joining Army Acquisition Priorities: Balancing Readiness and Modernization Forum, a face-to-face conference about the U.S. Army prioritizing modernization and acquisition. Register here!

Keeping Homeland Security and Meeting Global Challenges

The budget proposes to continue addressing global security concerns and encouraging the U.S. military. The plan seeks to uphold America’s commitment to veterans, families, and individuals while addressing urgent global concerns and enhancing border security and the U.S. immigration system.

Support International Allies and Partners

The budget retains support for European partner states and funding for Ukraine, a key ally in the United States’ partnership with NATO members. In addition to the United States and its NATO allies, the plan also prioritizes spending to improve the capabilities and preparedness of regional partners in the prolonged Russian aggression.

The United States also planned to strengthen its alliances and partnerships in the Indo-Pacific region. According to the Department of Defense’s 2024 Pacific Deterrence Initiative, $9.1 billion is being invested in U.S. force posture, infrastructure projects, presence, and readiness, as well as Indo-Pacific allies and partners.

Promote Democracy and Human Rights Worldwide

The U.S. invests $3.4 billion in global democracy and renewal. Budget proposals would protect free and fair election processes, build democratic institutions, combat corruption, promote gender equality and women’s civil rights, and advance technology for democracy.

Help with Immigration Enforcement and Border Security

The Administration remains committed to allocating $25 billion to CBP and ICE to increase border security and create secure legal migration pathways. The budget will be divided into several objectives:

- Hire an additional 350 Border Patrol Agents

- Get an additional 460 processing assistants for CBP and ICE

- $535 million for border technologies at checkpoints

- $40 million to fight fentanyl trafficking and disrupt criminal organizations

Enhance Military Health Protections Against Environmental Risks

The Toxic Exposures Fund (TEF) in 2024 receives $20.3 billion from the budget, an increase of $15.3 billion from the approved level in 2023. This is under the PACT Act, a law that gives healthcare advantages to Veterans who were exposed to burn pits and other dangerous chemicals.